61+ does getting pre approved for a mortgage affect credit score

This process is much more involved and is the key step in getting a mortgage. Web Nothing affects credit score more than your payment history.

Does Mortgage Pre Approval Affect Credit Scores

For example say your credit scores from the three credit bureaus are 723 716.

. This is called a hard inquiry because it can actually affect your score. Web Although getting pre-approved may be a slight ding to your credit score the upside to losing a few points for a few months far outweighs the risks. Web Keeping it no higher than 36 is considered optimum with no more than 28 going to your mortgage.

This move can decrease. If you pay off your debt and live debt-free eventually youll have no credit score. Web Key Takeaways.

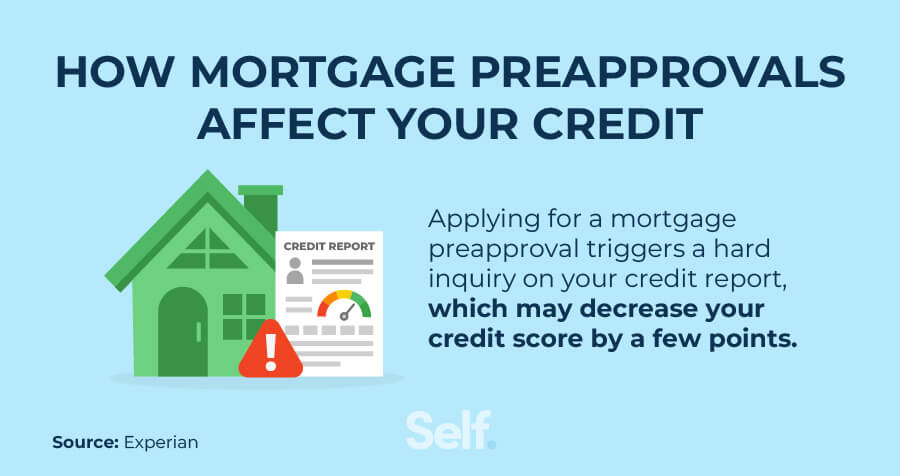

Lenders collect credit and financial information including credit history current debt and income. Web Mortgage preapproval requires a hard inquiry or a hard pull on one or more of your credit reports with the national credit bureaus. Why does your score drop when you get a new mortgage.

Web Pre-approval has an expiration date usually 60 to 90 days after receiving the letter. Plus if you apply for a mortgage within the. Do pre-approvals hurt your credit score.

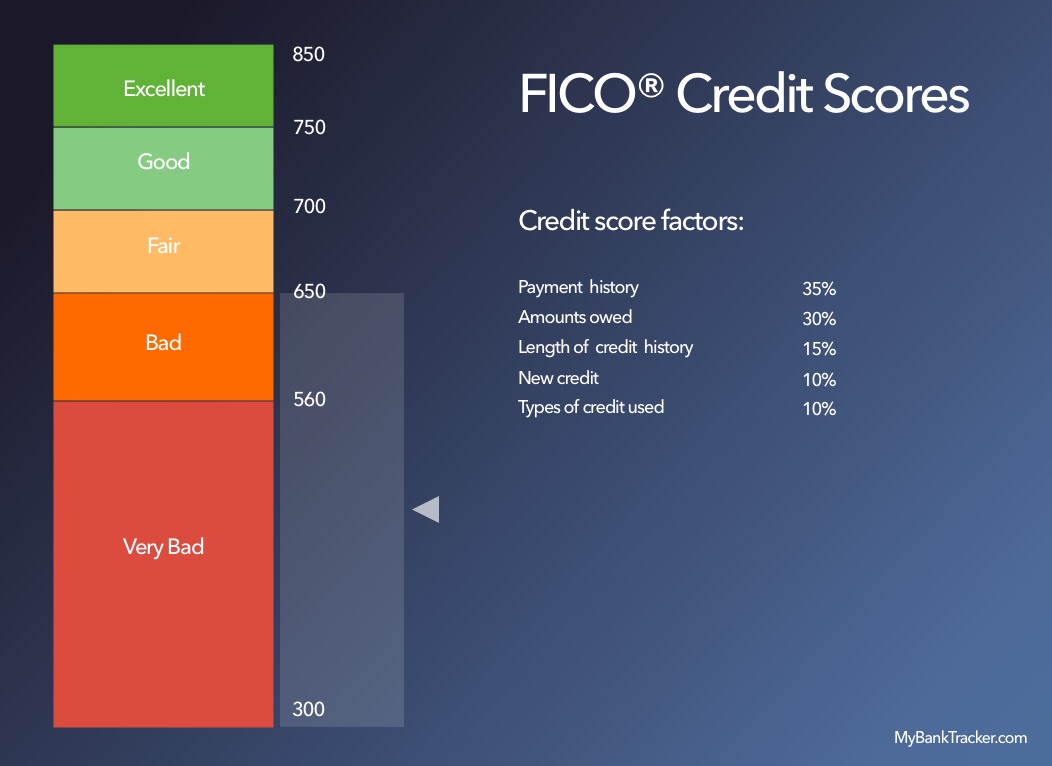

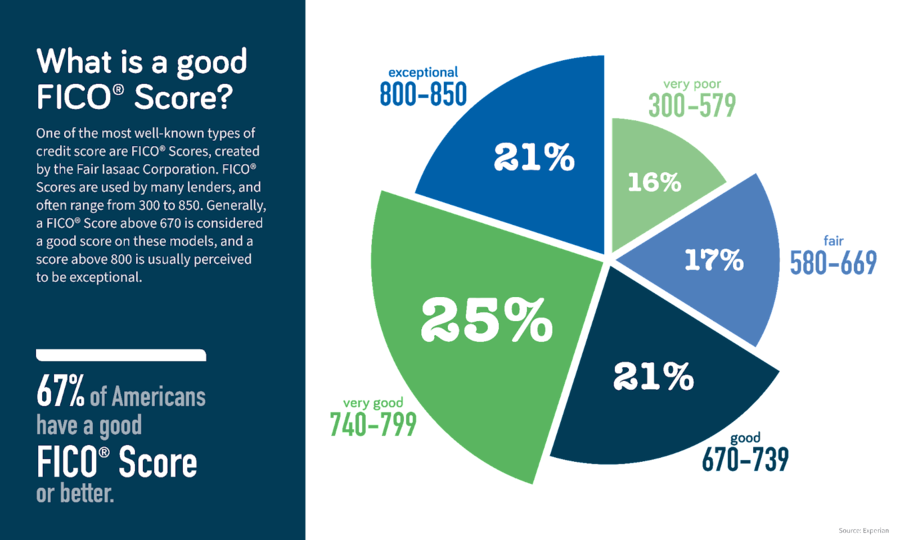

Web A soft credit inquiry which is used during the prequalification process does not affect credit scores so there is no risk in trying to find out whether youre at least in. If youre interested in getting pre. But youll notice that new credit including mortgage applications for pre-approval only accounts for about 10 of your overall FICO credit score.

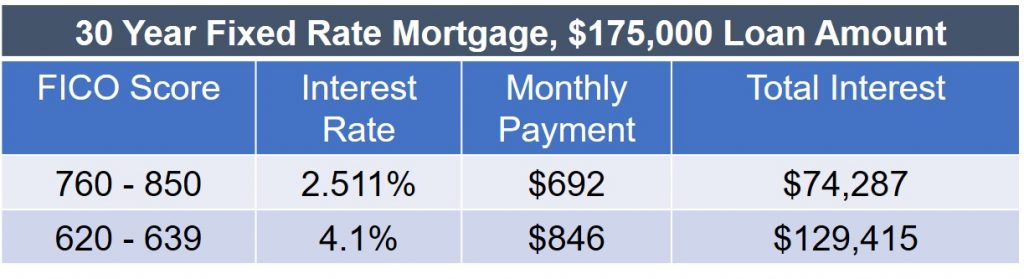

Youll complete a mortgage application and usually pay an. Web A mortgage preapproval helps you understand how much you may be able to borrow to buy a home makes you more attractive to sellers and alerts you to. In general a credit score above 670 will allow potential mortgage borrowers access to prime or favorable interest rates on their loan.

Getting pre-approved for a mortgage will hurt your credit but only by around 5 points. In short yes getting pre-approved for a mortgage can affect your credit score. Web A mortgage preapproval can have a hard inquiry on your credit score if you end up applying for the credit.

Web This type of inquiry does not affect your credit scores. Yes but not by much and only for a short period of time. Web How a Mortgage Preapproval Affects Your Credit.

Web Whats the minimum credit score for mortgage approval. Mortgages typically require 15 to 30 years of payments which is plenty of time to polish your score by making on. 2 If you know you will purchase a home in the near future.

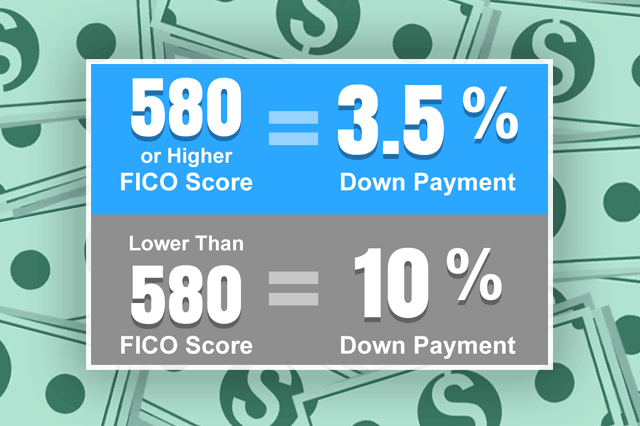

But the impact is likely to be less than you. You can typically get approved via FHA with a credit score as low as 580. FHA loans have the lowest credit score minimum of any loan program.

Web Over time these small steps will significantly impact your score and ultimately get approved for the mortgage you need. Scores below 620 are considered to be. The credit check required for a mortgage preapproval is identical to the one performed when you apply for a mortgage.

Web Does mortgage pre-approval affect credit score. Your mortgage is a big loan and. Although a preapproval may affect your credit score it.

Web On a joint mortgage all borrowers credit scores matter. A mortgage prequalification or preapproval. Since youve already been approved for your home loan this temporary drop may not matter much.

While it may knock off a few points it wont drop your score by a significant amount. Getting pre-approved for a mortgageeven by multiple lenders at oncewont hurt your credit score. Web If youre concerned about whether a mortgage prequalification or preapproval will affect your credit score heres a quick rundown.

Your pre-approval letter will likely specify the expiration date after which youll need to apply. Getting pre-approved for a mortgage will cause a hard inquiry. This check is considered a hard inquiry on your credit report which can temporarily lower your credit score a few points.

Once youve been approved for a mortgage and your loan closes your credit score may dip again. Lenders determine whats called the lower middle score and usually look at each applicants middle score. Web When a borrower applies for a home loan the lender will check their credit reports and scores.

Web Does Getting Pre-Approved Hurt Your Credit.

What Credit Score Do You Need To Get A Mortgage Learn The Key Fico Thresholds

24 Marketing Deck

Does Mortgage Pre Approval Affect Credit Score Total Mortgage

Payment System Report 2021 By Mnb Magyar Nemzeti Bank The Central Bank Of Hungary Issuu

Your Fha Loan Credit Qualifications

41st Field Artillery Brigade Germany Pcs Guide 101

Tm224337d14 Img001 Jpg

![]()

Does Mortgage Pre Approval Affect Credit Scores

Could Mortgage Pre Approval Hurt Your Credit Score

Pdf Caught Short Exploring The Role Of Small Short Term Loans In The Lives Of Australians Final Report Marcus Banks Academia Edu

Does Pre Approval Affect Your Credit Score Assurance Financial

Does Getting A Mortgage Preapproval Hurt Your Credit Score Self Credit Builder

Don T Let Mortgage Pre Approvals Sink Your Credit Score Real Estate News Insights Realtor Com

A Bad Credit Score Could Cost You Thousands Hire Your Money

Does Pre Approval Affect Your Credit Score Assurance Financial

Mortgage Pre Approvals Effect On Credit Credit Com

Does Pre Approval Affect Your Credit Score Assurance Financial